Biweekly mortgage calculator with taxes and insurance

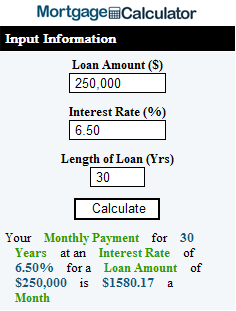

Compare the monthly payment for different terms rates and loan amounts to figure out what you might be able to afford. This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees.

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

We also offer a separate biweekly mortgage calculator.

. In the calculator the recurring costs are under the Include Options Below. Adding Subtracting Time. But under the wrong.

It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization. It is possible to arrange biweekly payments which permit faster repayment and a lower loan cost. 365 times per year.

Conventional loans require private mortgage insurance if you make less than 20 down payment on the homes purchase price. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. Are you starting biweekly payments in a middle of a loan schedule.

Property taxes home insurance HOA fees and other costs increase with time as a byproduct of inflation. Use this calculator to determine your monthly. This will be the only land contract calculator that you will ever need whether you want to calculate payments for residential or.

The HOA fee is included here if applicable. If you make less than a 20 down payment the estimated monthly PMI. PMI is usually included into your monthly mortgage payments costing between 05 1 of your loan amount annually.

Your homeowners insurance premium is divided by 12 to calculate this monthly amount. Mortgage Calculator with Taxes and Insurance. Using biweekly payments can accelerate your mortgage payoff and save you thousands in interest.

A biweekly payment means making a payment of one-half of the monthly payment every two weeks. This results in 26 payments a year instead of 24. The monthly vs biweekly mortgage calculator will find out how much faster you can pay off your mortgage with biweekly payments and how much you will save in interest payments.

This is an added cost that protects lenders in case borrowers default on their mortgage. They can save you thousands of dollars in interest and help you pay off your mortgage faster. Most home loans are structred as 30-year loans which is 360 monthy payments.

Mortgage Calculator with PMI Taxes Insurance and HOA biweekly. When a down payment is less than 20 percent home value the borrower must buy private mortgage insurance PMI. It protects the lender against some of losses.

24 times per. Vacant Land Loan Calculator to calculate monthly mortgage payments with a land contract amortization schedule. A 20-year loan is 240 monthly payments A 15-year loan is 180 monthly payments a 10-year loan is.

In this calculator you can inclue investments annuities alimony government benefit payments in the other income sources. Biweekly Mortgage Calculator Mortgage calculator with PMI terms. 26 times per year.

Check out the webs best free mortgage calculator to save money on your home loan today. The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage. A mortgage allows the option of building up a cash account.

How to Use the Mortgage Calculator. When you have a mortgage at some point you may decide to try and pay it off early. Biweekly mortgage payments are a good idea under the right circumstances.

52 times per year. The calculator divides your annual property taxes by 12 to calculate this monthly amount. It can be a good option for those wanting to contribute more money toward a.

It has many options that you may need such as PMI property tax home insurance monthly HOA fees and additional mortgage payment. Our calculator includes amoritization tables bi-weekly savings. This simple mortgage calculator was designed for making side-by-side comparisons of different monthly mortgage payments not including closing costs mortgage insurance or property taxes.

You can change the payment frequency. With biweekly mortgage payments you make 26 half-payments a year which equates to 13 total payments in a year. One option to consider is a biweekly every two week payment plan.

Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff. Be sure to select the correct frequency for your payments to calculate the correct annual income. Use this biweekly mortgage calculator to compare a typical monthly payment schedule to an accelerated biweekly payment.

Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

Mortgage Calculator Script Free Mortgage Calculator Widget

Biweekly Mortgage Calculator

Mortgage Calculator With Bi Weekly Payments

Downloadable Free Mortgage Calculator Tool

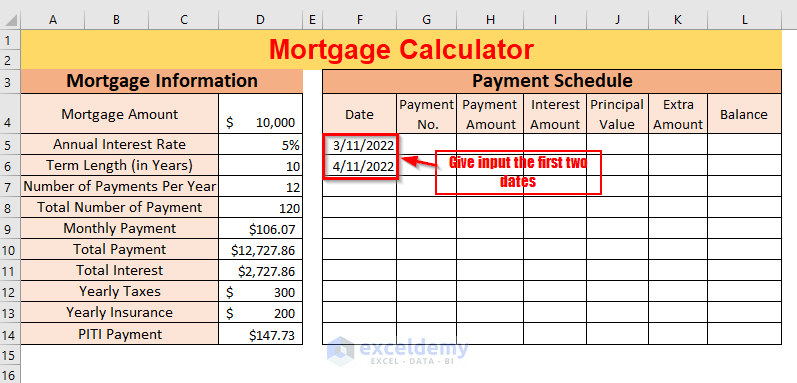

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Mortgage Calculator Money

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Creation Of A Mortgage Calculator With Taxes And Insurance In Excel

Best 10 Mortgage Calculator Apps Last Updated September 18 2022

Downloadable Free Mortgage Calculator Tool

Mortgage Calculator How Much Monthly Payments Will Cost

Mortgage Calculator With Taxes And Insurance

Top 10 Free Mortgage Calculator Widgets

Mortgage Calculator With Pmi Mortgage Calculator

Mortgage Calculator With Pmi Mortgage Calculator

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template