Payroll tax calculator 2020

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

How To Calculate Income Tax In Excel

The US Salary Calculator is updated for 202223.

. What does eSmart Paychecks FREE Payroll Calculator do. Learn About Payroll Tax Systems. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. How It Works. Then look at your last paychecks tax withholding amount eg.

The US Salary Calculator considers all deductions including Marital Status Marginal Tax rate and percentages income tax. Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Form TD1-IN Determination of Exemption of an Indians Employment Income.

That result is the tax withholding amount. The standard FUTA tax rate is 6 so your max. Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

The 2020 Tax Calculator uses the 2020 Federal Tax Tables and 2020 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Federal Salary Paycheck Calculator.

Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions. Ad Run your business. You first need to enter basic information about the type of payments you make.

Sign Up Today And Join The Team. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. 3 Months Free Trial.

Small Business Low-Priced Payroll Service. 2020 Federal income tax withholding calculation. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to.

It will confirm the deductions you include on your. Sage Income Tax Calculator. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms. 250 and subtract the refund adjust amount from that. The calculator is updated with the tax rates of all Canadian provinces and.

Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. Estimate your federal income tax withholding. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or.

Well run your payroll for up to 40 less. Calculate how tax changes will affect your pocket. The tool then asks you.

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Your employer withholds a 62 Social Security tax and a. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Over 900000 Businesses Utilize Our Fast Easy Payroll. The payroll tax rate reverted to 545 on 1 July 2022. Use this tool to.

The 202021 tax calculator provides a full payroll salary and tax calculations for the 202021 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations. States dont impose their own income tax for tax year 2022. Starting as Low as 6Month.

Thats where our paycheck calculator comes in. Subtract 12900 for Married otherwise. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

Sign Up Today And Join The Team. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. Over 900000 Businesses Utilize Our Fast Easy Payroll.

You can use the calculator to compare your salaries between 2017 and 2022. Free Unbiased Reviews Top Picks. 250 minus 200 50.

Ad Compare This Years Top 5 Free Payroll Software. Big on service small on fees. Free Unbiased Reviews Top Picks.

Its so easy to. Get your payroll done right every time. Salary commission or pension.

Median household income in 2020 was 67340. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Free salary hourly and more paycheck calculators.

How to use a Payroll Online Deductions Calculator. Learn About Payroll Tax Systems. If your monthly paycheck is 6000 372 goes to Social Security and.

Ad Compare This Years Top 5 Free Payroll Software. The maximum an employee will pay in 2022 is 911400. See how your refund take-home pay or tax due are affected by withholding amount.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Excel Formula Income Tax Bracket Calculation Exceljet

Income Tax Formula Excel University

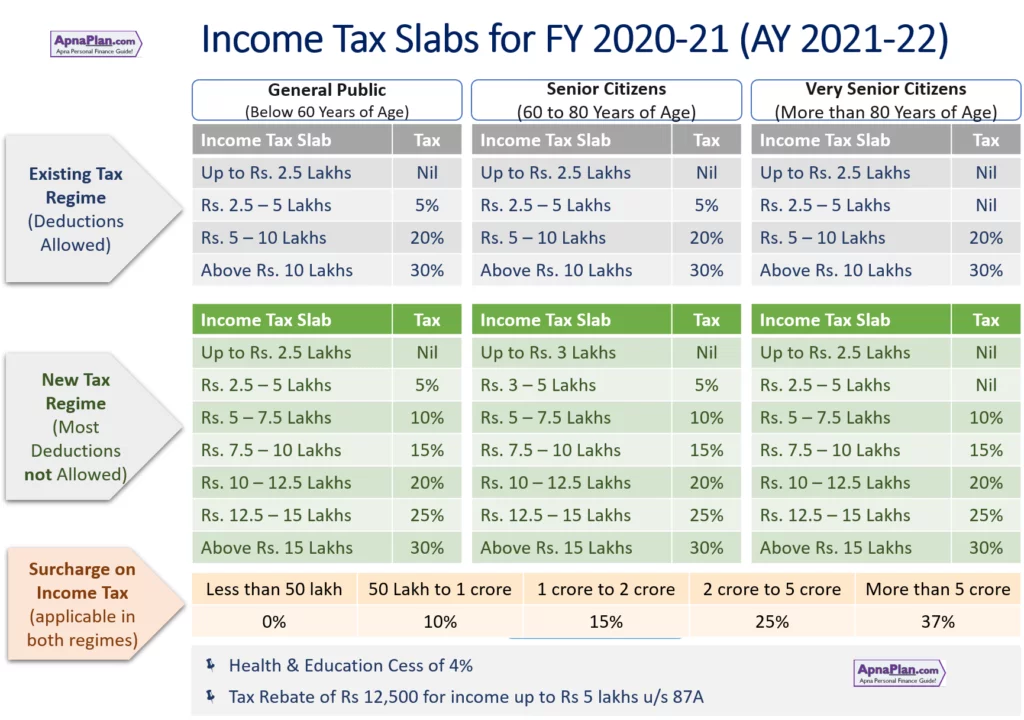

How To Calculate Income Tax Fy 2021 22 New Tax Slabs Rebate Income Tax Calculation 2021 22 Youtube

Income Tax Formula Excel University

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

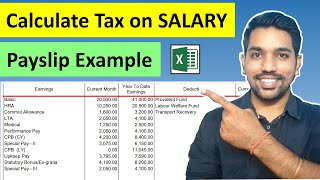

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Payroll Taxes Methods Examples More

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Taxtips Ca Ontario 2019 2020 Income Tax Rates

How To Calculate Income Tax In Excel

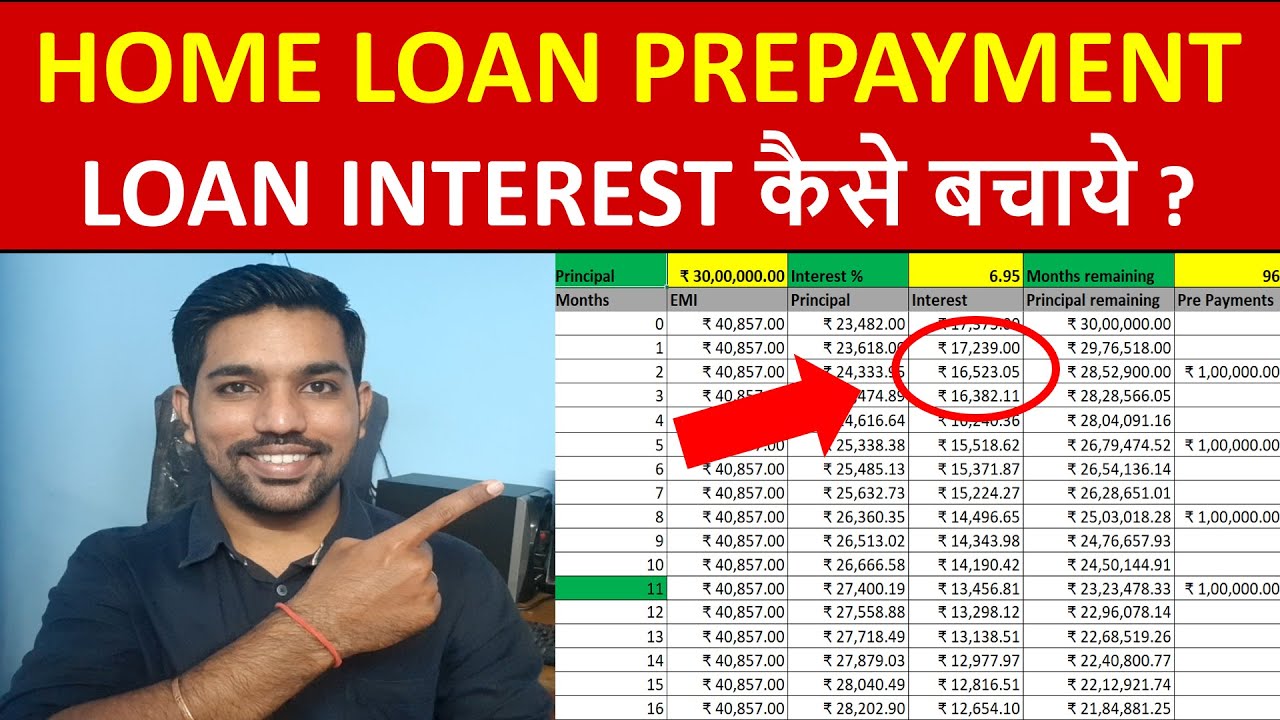

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Tax Rate Calculator Flash Sales 54 Off Www Ingeniovirtual Com