33+ how much should your mortgage be

Compare Home Financing Options Online Get Quotes. Web Lenders examine how much debt you have compared to how much income you earn.

How Much Of My Income Should Go Towards A Mortgage Payment

Compare Home Financing Options Online Get Quotes.

. Get a clear breakdown of your potential mortgage payments with taxes and insurance. For a 250000 home a down payment of. That might sound exciting at first but with a.

Ad See how much house you can afford. Lock In Your Low Rate Today. Well Help You Estimate Your Monthly Payment.

Web Based on your DTI and depending on your other debts you could be approved for a mortgage of 600000. Web According to Redfins market insights a home buyer who is able to afford to make a monthly payment of 2500 could afford to purchase a 384000 home at the. Web As mentioned above the rule of thumb is that you can typically afford a mortgage two to 25 times your yearly wage.

Easily Compare Mortgage Rates and Find a Great Lender. Mark Harris chief executive of mortgage broker. It Pays To Compare Offers.

Your monthly debt payments would be. For example some experts say you should spend no more. Web For example assume you pay 1200 for your mortgage 400 for your car and 400 for the rest of your debts each month.

Web Below two brokers explain how much you should borrow on your current salary when looking to buy a home. Web Lets say you want to keep your DTI at or below 35. Ad See what your estimated monthly payment would be with the VA Loan.

Although its a myth that a 20 down payment is required to obtain a loan keep in mind that the higher your down. Ad Need To Know How Much You Can Afford. With a general budget you want to.

Web A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability. Try our mortgage calculator. This is known as your debt-to-income ratio DTI.

Published Wed Jul 14 2021 1132 AM EDT Updated Thu. Ad First Time Home Buyer. Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Estimate your monthly mortgage payment. Thats a mortgage between 120000 and.

Are You Eligible For The VA Loan. Web At todays interest rate of 633 a 15-year fixed-rate mortgage would cost approximately 2585 per month in principal and interest per 300000. 43 043 x 5000 2150 Max debt payments.

Web How much mortgage can you afford. Web 5000 x 036 36 1800 Maximum debt obligation including mortgage payment Going by the 28 percent rule the borrower should be able to reasonably afford. Web If you also pay 250 per month for student loans and 200 per month for your credit cards for example your back-end DTI ratio would be 33 1000 250.

Get an idea of your estimated payments or loan possibilities. Ad Calculate and See How Much You Can Afford. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

Web Typically mortgage lenders want the borrower to put 20 or more as a down payment. Web This mortgage calculator will help you estimate the costs of your mortgage loan. 1000 Max home expenses.

Ideally your DTI should be. Ad Top Home Loans. In some cases borrowers may put down as low as 3.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. Find The Right Mortgage For You By Shopping Multiple Lenders.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web To get an idea about how much you might pay in interest consider that the current 30-year fixed-rate mortgage of 698 on a 100000 loan will cost 664 per. Well Help You Estimate Your Monthly Payment.

Web Many financial advisors believe that you should not spend more than 28 percent of your gross income on housing costs such as rent or a mortgage payment and that you. Web Most home loans require at least 3 of the price of the home as a down payment. Web Use the 30 and 2836 rules to figure out how much you should be spending on housing.

Web If you buy a home with a loan for 200000 at 433 percent your monthly payment on a 30-year loan would be 99327 and you would pay 15757691 in interest. Ad Need To Know How Much You Can Afford. Some loans like VA loans and some USDA loans allow zero down.

Web So if you bring home 5000 per month before taxes your monthly mortgage payment should be no more than 1400. To consider how much you can afford in a mortgage payment multiply your comfortable DTI by your gross. If the borrowers make a down.

Start By Checking The Requirements.

2328 Sequoya Dr Lafayette In 47909 Zillow

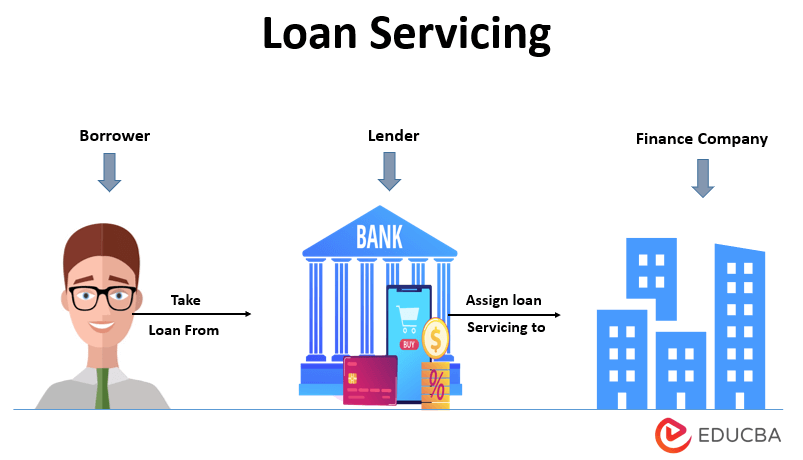

Loan Servicing How Does Loan Servicing Work With Example

Loan Chart Mortgage Mortgage Loans Home Loans

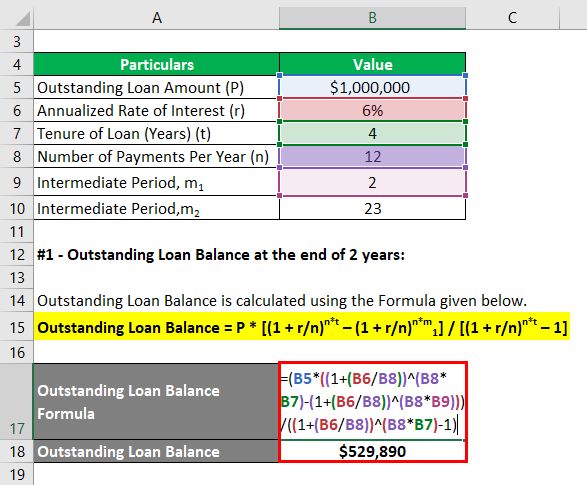

Mortgage Formula Examples With Excel Template

What Is Fannie Mae Purpose Eligibility Limits Programs

33 Most Flexible Part Time Jobs For Your Schedule

How Much House Can You Afford Calculator Cnet Cnet

What Is Mortgage

Betterment Resources Original Content By Financial Experts App

How Much A 350 000 Mortgage Will Cost You Credible

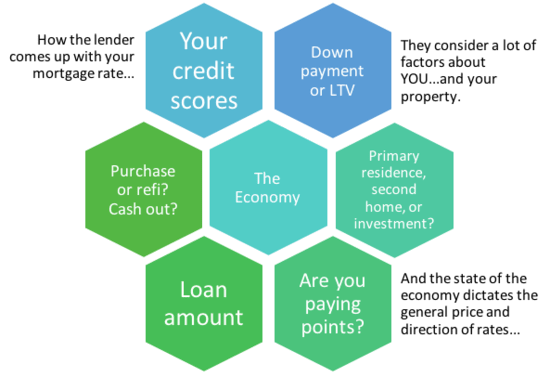

Mortgage Rates Explained A Complete Guide To Get You Up To Speed Fast

Passive Real Listen To All Episodes Business Economics

Foreclosure Help Moshes Law

6625 Private Road 4041 Caldwell Tx 77836 Compass

Commercial Real Estate Crm Ergonized Services

Okanagan Falls Real Estate Okanagan Falls 33 Homes For Sale Zolo Ca

New York Foreclosure Defense Law Office Of Yuriy Moshes